Just two months into 2026, there is still plenty of time for a fresh start. For many, that fresh start means finally stepping into homeownership. According to Clinton Howell, Broker with RE/MAX Escarpment Realty Inc., buying your first home should feel exciting, not overwhelming.

For first-time home buyers in Burlington, the journey can feel intimidating. High prices, paperwork, bidding wars, and uncertainty about the process often create stress. But with the right education and guidance, the experience can be empowering and even enjoyable.

Here is how buyers can confidently approach the 2026 market.

Get Educated Before You Shop

Education is the foundation of confidence. Clinton emphasizes that informed buyers make better decisions and feel less anxious throughout the process.

Understanding financing is the first step. Buyers should learn how mortgage pre-approvals work, what lenders evaluate, and how interest rates affect affordability. Beyond the purchase price, it is critical to understand additional costs such as closing costs, legal fees, land transfer taxes, home inspections, and moving expenses. These are often overlooked by first-time buyers.

When buyers fully understand the process, conversations become more productive. Instead of worrying about unknowns, they can focus on identifying the right property. Knowledge removes surprises and builds direction.

Align Your Purchase with Your Lifestyle

Buying a home is not just about today. It is about the next five to ten years.

Clinton encourages buyers to think long term. Are you planning to start a family? Adopt a pet? Work remotely? Move an aging parent in? Your lifestyle goals should shape your property choice.

In Burlington, neighbourhood selection is just as important as the home itself. Proximity to schools, transit, parks, and amenities plays a major role in long-term satisfaction and resale value. Buyers who plan properly are less likely to feel pressured to sell too soon.

Setting realistic expectations is also key. Once buyers understand what their budget can truly secure in today’s market, they can approach the search strategically instead of emotionally.

Manage Emotions and Embrace the Excitement

Almost every first-time buyer feels nervous. Many have heard stories about bidding wars or buyers who looked at dozens of homes without success. Media headlines tend to amplify negative market narratives.

However, most homeowners are ultimately happy with their purchase.

Clinton’s role is to guide clients through the emotional highs and lows. When a suitable property appears, he analyzes comparable sales, evaluates true market value, and develops a smart offer strategy. This practical approach prevents buyers from overspending due to emotion.

Having a trusted professional managing pricing strategy and negotiations builds confidence. When buyers know someone is protecting their financial interests, they can focus on the excitement of ownership instead of fear.

Take Action Early in the Year

The beginning of the year presents a strategic opportunity.

First, secure a mortgage pre-approval. This clarifies buying power and strengthens negotiating leverage. Sellers view pre-approved buyers as serious and prepared.

Second, narrow down preferred property types and neighbourhoods. Even if you are not ready to purchase immediately, starting early allows you to study the market. Watching listings, understanding pricing trends, and touring properties builds valuable insight.

This preparation ensures you are ready to act confidently when the right opportunity appears, rather than reacting under pressure.

Recognize Current Market Advantages

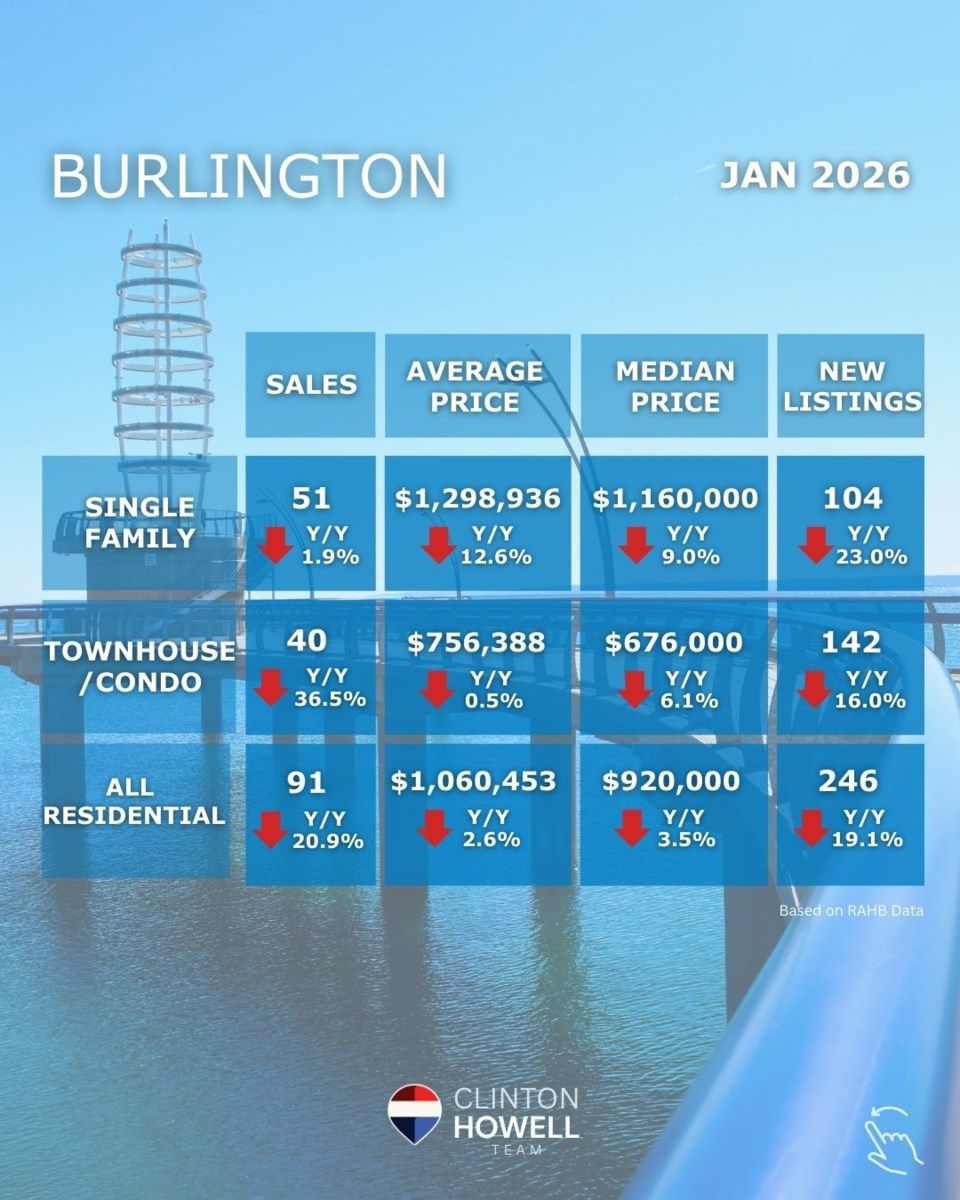

While affordability remains a challenge, certain market conditions in early 2026 favour first-time buyers.

Interest rates, while higher than the historic lows of 2021, are still historically reasonable. Compared to peak pricing in 2022, many homes have adjusted downward. When factoring in today’s rates and moderated pricing, monthly payments and down payment requirements can be more manageable than during the peak frenzy.

Inventory levels are also healthier. With more listings available and fewer bidding wars, buyers have breathing room. Negotiation power has improved. Conditions such as financing and home inspections are more commonly accepted, offering additional protection.

Winter months typically bring less competition, which can further benefit methodical buyers who prefer time to evaluate options carefully.

Trusted Guidance Makes the Difference

With experience helping hundreds of buyers across Burlington, Waterdown, Ancaster, and surrounding communities, Clinton Howell focuses on turning what could be an overwhelming process into a structured, supportive experience.

His team was recently recognized with the BurlingtonToday.com Reader Favourite Award for Top Real Estate Team, reflecting their commitment to excellence and client education.

For first-time home buyers in Burlington, 2026 presents opportunity. With preparation, education, and trusted guidance, buying your first home can mark the beginning of an exciting new chapter rather than a stressful ordeal.

The key is simple: get informed, plan strategically, manage emotions, and take action early. When approached thoughtfully, homeownership becomes not just a financial milestone, but a meaningful life achievement.